Table of Contents

Introduction

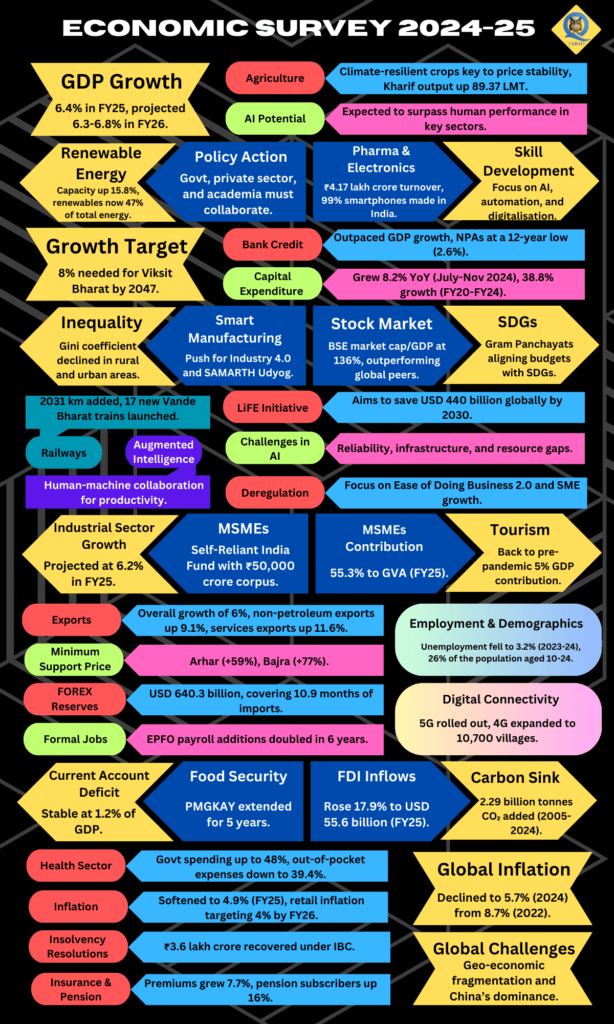

The Economic Survey 2024-25, published by the Ministry of Finance, presents an intricate dissection of India’s economic trajectory over the past fiscal year, offering a meticulous analysis of macroeconomic trends, sectoral advancements, and strategic policy orientations necessary for fostering sustained economic expansion within an increasingly volatile global landscape.

The report not only delineates past performance but also offers forward-looking projections, highlighting potential areas of policy intervention to enhance economic resilience and dynamism. By providing a granular examination of key economic indicators, the survey serves as a foundational document guiding fiscal and monetary policy formulation.

Chapter 1: State of the Economy – Getting Back into the Fast Lane

- Global Economic Scenario

- In 2024, the global economy showed steady but uneven growth.

- Manufacturing slowed, especially in Europe and parts of Asia, due to supply chain disruptions and weak external demand.

- The services sector performed better, supporting overall growth.

- Inflation eased in most economies, but services inflation remained persistent.

- Commodity prices stabilized, but risks of synchronized price increases continued.

- Geopolitical tensions, trade risks, and conflicts posed challenges to global stability.

- India’s Economic Performance

- India’s real GDP is estimated to grow at 6.4% in FY25, driven by agriculture and services.

- Rural demand improved due to record Kharif production and favorable agricultural conditions.

- The manufacturing sector faced pressures from weak global demand and seasonal factors.

- Private consumption remained stable, reflecting strong domestic demand.

- Macroeconomic stability was supported by fiscal discipline, a trade surplus in services, and healthy remittances.

- Future Outlook for FY26

- Growth is expected to be between 6.3% and 6.8%, depending on various factors.

- Risks include geopolitical uncertainties, trade disruptions, and potential commodity price shocks.

- Strengthening domestic investment, improving consumer confidence, and boosting corporate wages will be crucial for sustained growth.

- Structural reforms and deregulation are needed to enhance India’s global competitiveness and drive long-term economic expansion

Chapter 2: Monetary and Financial Sector Developments – Stability and Growth

- Monetary Policy Developments

- The Reserve Bank of India (RBI) maintained the repo rate at 6.5% throughout most of 2024 to balance inflation control and growth.

- In December 2024, the RBI reduced the Cash Reserve Ratio (CRR) from 4.5% to 4%, injecting ₹1.16 lakh crore liquidity into the banking system.

- Broad Money (M3) growth slowed to 9.3% year-on-year (YoY) in December 2024 from 11% in 2023, indicating a moderated expansion in money supply.

- Banking Sector Performance

- The Gross Non-Performing Assets (GNPA) ratio fell to a 12-year low of 2.6% in September 2024, improving asset quality across all banking groups.

- The Capital-to-Risk Weighted Assets Ratio (CRAR) increased to 16.7%, reflecting stronger capital buffers.

- Bank credit grew by 11.8% YoY as of November 2024, but the rate of expansion moderated compared to previous years.

- Financial Inclusion and Capital Markets

- The Financial Inclusion Index rose from 53.9 in March 2021 to 64.2 in March 2024, highlighting improvements in banking access.

- The number of IPOs increased sixfold from FY13 to FY24, showcasing rising equity-based financing.

- Stock markets reached new highs, with BSE’s market capitalization hitting ₹445.2 lakh crore in December 2024, up 14.2% since March 2024.

- Challenges and Outlook

- Consumer credit surged to 32.4% of total bank credit in FY24, raising concerns over rising unsecured lending.

- The credit-to-GDP gap narrowed from (-)10.3% in Q1 FY23 to (-)0.3% in Q1 FY25, indicating sustainable credit growth.

- Insurance penetration is expected to make India the fastest-growing market among G20 nations from 2024-2028.

- Future monetary policies will focus on maintaining financial stability, balancing credit expansion, and managing emerging risks in consumer lending and capital markets.

Chapter 3: External Sector – Strengthening Global Ties

- Trade Performance and Global Headwinds

- India’s total exports (merchandise and services) reached $602.6 billion in the first nine months of FY25, growing by 6% year-on-year.

- Merchandise exports, excluding petroleum and gems & jewelry, rose by 10.4%, showing strength in diversified product categories.

- Total imports for the same period were $682.2 billion, growing 6.9%, driven by steady domestic demand.

- Global trade uncertainties, including rising protectionism and geopolitical disruptions (such as Red Sea tensions), impacted trade routes and costs.

- Foreign Investment Trends

- Foreign Direct Investment (FDI) showed signs of revival, with gross FDI inflows increasing by 17.9% year-on-year from April to November 2024.

- Net FDI inflows, however, declined due to a 33.2% increase in repatriation as multinational corporations pursued profitable exits.

- Foreign Portfolio Investment (FPI) inflows stood at $10.6 billion from April to December 2024, lower than the $31.7 billion recorded in the previous year, reflecting global market uncertainties.

- Foreign Exchange Reserves and Stability

- India’s foreign exchange reserves stood at $640.3 billion as of December 2024, sufficient to cover 90% of the country’s external debt ($711.8 billion as of September 2024).

- The external debt-to-GDP ratio increased slightly to 19.4% in September 2024 from 18.8% in June 2024, maintaining overall stability.

- The share of short-term external debt declined to 18.8%, strengthening India’s financial resilience.

- Future Outlook and Policy Directions

- India must focus on reducing trade costs, improving export facilitation, and integrating into global supply chains to enhance competitiveness.

- Expanding trade agreements and strengthening bilateral ties will be critical in countering rising protectionism.

- The government is expected to continue easing business regulations and promoting FDI inflows to sustain external sector growth.

Chapter 4: Prices and Inflation – Managing Economic Stability

- Global and Domestic Inflation Trends

- Global inflation declined from 8.7% in 2022 to 5.7% in 2024, aided by monetary tightening and easing supply chain disruptions.

- In India, retail inflation eased from 5.4% in FY24 to 4.9% in FY25 (April-December), despite fluctuations in food prices.

- Core inflation reached its lowest level in a decade, driven by a reduction in fuel prices and stable wholesale price inflation.

- Food Price Inflation and Key Drivers

- Food inflation remained high, with vegetables and pulses accounting for 32.3% of total inflation despite having only an 8.42% weight in the Consumer Price Index (CPI).

- Excluding high-volatile items like tomatoes, onions, and potatoes, headline inflation would be 4.2%, lower than the reported rate.

- Extreme weather events, including unseasonal rainfall and heatwaves, contributed to crop damage and supply chain disruptions.

- Onion and tomato prices surged due to lower production, requiring government interventions such as buffer stocking and subsidized retail sales.

- Government Measures to Control Inflation

- The government imposed stock limits on wheat, pulses, and onions to curb hoarding and stabilize prices.

- Open market sales of essential commodities and duty-free imports of key food items were implemented to boost supply.

- The “Bharat Brand” initiative was launched to provide pulses at subsidized rates and reduce price volatility.

- Outlook for Inflation Control

- Inflation is expected to gradually align with targets, with the Reserve Bank of India projecting a 4.2% inflation rate in FY26.

- A normal monsoon and stable global commodity prices will be crucial in determining future price movements.

- Long-term solutions include developing climate-resilient crops, enhancing food storage infrastructure, and improving supply chain efficiency.

Chapter 5: Medium-Term Outlook – Growth Through Deregulation

- India’s Economic Growth Prospects

- To achieve its goal of becoming a developed economy (Viksit Bharat) by 2047, India needs to sustain an 8% annual GDP growth rate for the next two decades.

- The IMF projects India’s economy to reach $5 trillion by FY28 and $6.3 trillion by FY30, translating to an average nominal growth rate of 10.2% per year.

- Over the past three decades (FY94-FY24), India’s GDP in USD terms grew at a compounded annual rate of 8.9%, and future projections indicate even stronger growth.

- Geo-Economic Fragmentation and Global Challenges

- Global trade and investment patterns are shifting due to rising protectionism and geopolitical tensions.

- Over 24,000 new trade restrictions have been imposed globally between 2020 and 2024, affecting supply chains and trade volumes.

- The rise of China as a manufacturing powerhouse poses challenges for other economies, especially in energy transition materials and high-tech manufacturing.

- Domestic Growth Drivers and Policy Reforms

- India’s economic resilience depends on reducing regulatory burdens, promoting entrepreneurship, and improving infrastructure.

- Key reforms include simplifying business regulations, enhancing ease of doing business, and improving labor market flexibility.

- The Make in India and Atmanirbhar Bharat initiatives are expected to drive domestic manufacturing and job creation, reducing dependency on imports.

- Outlook and Strategic Focus

- The rupee’s projected depreciation of just 0.5% per year (compared to 3.3% in the past three decades) indicates stronger investor confidence.

- A gradual increase in the current account deficit to 2.2% of GDP by FY30 is expected but remains within manageable limits.

- The government’s focus on energy transition, infrastructure development, and technological innovation will be crucial in maintaining high growth rates.

India’s medium-term growth trajectory depends on continued reforms, financial sector modernization, and global economic integration, ensuring long-term economic stability.

Chapter 6: Investment and Infrastructure – Driving Growth Through Development

- Infrastructure Investment and Expansion

- The National Infrastructure Pipeline (NIP) targeted ₹111 lakh crore in infrastructure investment from FY20 to FY25, covering 9,766 projects across 37 sub-sectors.

- The National Monetisation Pipeline (NMP) aimed to unlock ₹6 lakh crore from underutilized public assets between FY22 and FY25, achieving ₹3.86 lakh crore in completed transactions by FY24.

- The FY25 infrastructure monetization target is set at ₹1.91 lakh crore, focusing on roads, power, coal, and mines.

- Capital Expenditure and Development Programs

- The government’s capital expenditure on major infrastructure sectors grew at a trend rate of 38.8% from FY20 to FY24.

- Infrastructure-related ministries utilized 60% of their budgeted capital expenditure between April and November 2024, with spending momentum increasing post-elections.

- The Swadesh Darshan 2.0 initiative approved 34 projects with a total funding of ₹793.2 crore, aimed at developing sustainable tourism destinations.

- Sectoral Developments

- Railways: 17 new pairs of Vande Bharat trains were introduced between April and October 2024, with 228 additional coaches produced.

- Airports: Cargo handling capacity reached 8 million metric tons (MT) in FY24, and the UDAN scheme operationalized 619 routes and 88 regional airports.

- Ports: Port capacity saw significant expansion, reducing average container turnaround time and improving logistics efficiency.

- Urban Infrastructure: The Smart Cities Mission completed over 1,200 projects, including 16 lakh solar/LED streetlights and 9,400 smart classrooms.

- Future Challenges and Policy Directions

- Despite public sector efforts, the gap in infrastructure demand remains high, requiring greater private sector participation and innovative financing models.

- The government’s focus on sustainable construction and climate-resilient infrastructure will be key to long-term economic growth.

- Expanding public-private partnerships (PPP) and improving risk-sharing mechanisms will be critical in attracting private investment in core infrastructure projects.

Chapter 7: Industry – Strengthening Manufacturing and Innovation

- Industrial Growth and Performance

- The industrial sector grew by 6.2% in FY25, supported by expansion in electricity and construction despite a slowdown in manufacturing exports.

- Core industrial sectors such as steel, cement, and chemicals showed resilience, with production increasing to meet domestic demand.

- The capital goods sector recorded robust growth, but reliance on imports remains a challenge due to technology gaps.

- Sector-Wise Highlights

- Automobile Industry: Domestic auto sales grew by 12.5% in FY24, with the government extending the PLI scheme for electric and hybrid vehicles to boost production.

- Electronics Industry: India’s domestic electronics production surged to ₹9.52 lakh crore in FY24, with 99% of smartphones now manufactured domestically.

- Textile and MSMEs: Small and medium enterprises (MSMEs) employed over 23.2 crore individuals, highlighting the sector’s role in job creation.

- Regional Disparities in Industrial Growth

- Gujarat, Maharashtra, Karnataka, and Tamil Nadu contributed 43% of total industrial Gross State Value Added (GSVA) in FY23.

- Northeastern states (excluding Sikkim and Assam) accounted for just 0.7% of industrial GSVA, emphasizing the need for targeted industrial policies.

- Challenges and Future Strategy

- Import dependency in key industries like coal, capital goods, and chemicals continues to pose challenges.

- Innovation and R&D spending remain low, with most investments concentrated in pharmaceuticals and IT.

- Future growth requires deregulation, improved business reforms, and stronger industry-academia collaboration to boost productivity and competitiveness.

Chapter 8: Services – Adapting to New Challenges

- Services Sector Performance and Growth

- The services sector contributed 55% of India’s Gross Value Added (GVA) in FY25, reinforcing its role as the primary driver of economic growth.

- India’s services exports surged by 12.8% in April-November FY25, with computer services and professional services accounting for 70% of total services exports.

- The Financial, Real Estate, and Professional Services segment contributed nearly 45% of total services GVA growth in the first half of FY25.

- Banking and Financial Services Expansion

- Outstanding bank credit to the services sector reached ₹48.5 lakh crore as of November 2024, registering a 13% year-on-year growth.

- The highest credit growth was recorded in computer software (22.5%) and professional services (19.4%), highlighting digital transformation.

- FDI equity inflows into the services sector stood at $5.7 billion in FY25 (April-September), with insurance services receiving 62% of total FDI in the sector.

- Growth in IT and Digital Services

- India’s IT/ITeS industry reached $254 billion in FY24, growing 3.8% year-on-year, with tech exports contributing nearly $200 billion.

- The sector added 60,000 employees, expanding the workforce to 5.43 million in FY24.

- Emerging digital platforms like the Open Network for Digital Commerce (ONDC) and AI-driven automation are reshaping service delivery and e-commerce.

- Tourism and Hospitality Recovery

- Domestic tourist visits rebounded to pre-pandemic levels, fueling growth in hotels, restaurants, and travel-related services.

- The government’s Swadesh Darshan 2.0 scheme aims to further promote sustainable tourism development.

- Challenges and Future Outlook

- Regulatory risks in IT and professional services are increasing, particularly due to global shifts in outsourcing policies.

- The servicification of manufacturing is leading to greater integration of services into industrial production, creating new business models.

- Future growth will depend on enhancing digital infrastructure, skill development, and adapting to AI-driven transformations in the services landscape.

Chapter 9: Agriculture and Food Management – Sector of the Future

- Agricultural Growth and Contribution to GDP

- Agriculture contributed 16% to India’s GDP in FY25, supporting 46.1% of the population.

- The sector grew at an average rate of 5% per year between FY17 and FY23, demonstrating resilience despite climate challenges.

- In Q2 of FY25, agriculture grew by 3.5%, recovering from the previous four quarters, where growth ranged between 0.4% and 2.0%.

- Crop Production and Diversification

- High-value sectors such as horticulture, livestock, and fisheries emerged as primary growth drivers.

- The fishery sector had the highest compound annual growth rate (CAGR) of 13.67%, followed by livestock at 12.99% from FY15 to FY23.

- Oilseeds production grew at a slower 1.9% CAGR, raising concerns due to heavy reliance on edible oil imports.

- Agriculture Credit and Mechanization

- The Pradhan Mantri Fasal Bima Yojana (PMFBY) insured 4 crore farmers in FY24, covering 600 lakh hectares, marking a 26% rise in farmer enrollment over FY23.

- The Sub-Mission on Agricultural Mechanization (SMAM) helped establish 26,662 Custom Hiring Centres (CHCs), making farm machinery more accessible.

- A government scheme introduced drones for 15,000 Women Self-Help Groups (SHGs), providing an additional income stream of ₹1 lakh per year per SHG.

- Irrigation and Climate Adaptation

- The irrigated area as a percentage of gross cropped area increased from 49.3% in FY16 to 55% in FY21.

- States like Punjab, Haryana, and Uttar Pradesh have irrigation coverage above 80%, while Jharkhand and Assam lag behind at less than 20%.

- Climate change increased dry spells during monsoon seasons by 27% from 1981 to 2011 compared to 1951 to 1980, requiring stronger adaptation strategies.

- Government Initiatives for Sustainability

- The Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for the Northeast Region (MOVCDNER) supported over 25 lakh farmers in adopting organic farming.

- The e-NAM platform improved market access for farmers, strengthening price discovery and market efficiency.

- Government reforms such as PM-KISAN and Pradhan Mantri Kisan Maandhan Yojna (PMKMY) provided direct income support and pension benefits to over 11 crore farmers.

India’s agricultural future depends on enhancing productivity, adopting climate-resilient farming techniques, improving supply chains, and leveraging technology to ensure food security and economic growth.

Chapter 10: Climate and Environment – Adapting for a Sustainable Future

- India’s Commitment to Low-Carbon Growth

- India’s per capita carbon emissions are one-third of the global average, despite being one of the fastest-growing economies.

- The country aims to achieve net-zero emissions by 2070 while maintaining strong economic growth.

- Adaptation spending increased from 3.7% of GDP in FY16 to 5.6% in FY22, highlighting the focus on climate resilience.

- Renewable Energy and Green Transition

- India has installed over 180 GW of renewable energy capacity, with a target of 500 GW by 2030.

- Challenges include limited access to critical minerals and energy storage technology, affecting large-scale renewable deployment.

- The government launched the Green Hydrogen Mission to promote clean energy alternatives in industrial and transportation sectors.

- Climate Finance and Global Cooperation

- At COP29, developed nations pledged only $300 billion annually by 2035, falling short of the estimated $5.1-$6.8 trillion needed by 2030 for global climate action.

- India has largely self-financed its climate efforts, as international financial flows remain inadequate and biased towards mitigation rather than adaptation.

- Environmental Challenges and Adaptation Strategies

- India is the seventh most climate-vulnerable country, facing rising temperatures, erratic monsoons, and extreme weather events.

- Urban adaptation initiatives under the National Mission on Sustainable Habitat (NMSH) focus on waste management, water conservation, and sustainable mobility.

- The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) completed 785 stormwater drainage projects, addressing 3,631 waterlogging points across Indian cities.

- Over 5,070 acres of green space and 493 km of pedestrian and cycling tracks have been developed to support climate-friendly urban living.

- Outlook and Future Policy Directions

- The Lifestyle for Environment (LiFE) initiative, launched at COP26, aims to shift consumption patterns towards sustainability.

- Circular economy principles are being promoted through plastic waste reduction, e-waste recycling, and water conservation initiatives.

- India’s future climate strategy requires enhanced global cooperation, financial support, and technological innovation to achieve its sustainability goals while ensuring economic resilience.

Chapter 11: Social Sector – Extending Reach and Driving Empowerment

- Education and Skill Development

- School enrollment rates have improved, with over 96% of children aged 6-14 attending school under the Samagra Shiksha Abhiyan.

- Foundational literacy and numeracy (FLN) programs have reached 3.8 crore children, improving learning outcomes.

- Higher education saw a rise in Gross Enrollment Ratio (GER) to 28.4%, with female enrollment surpassing male enrollment in several states.

- Over 1.5 crore youth trained under the Pradhan Mantri Kaushal Vikas Yojana (PMKVY) to enhance employability.

- Healthcare and Social Welfare Initiatives

- 1.75 lakh Ayushman Arogya Mandirs (AAMs) have been set up, providing free healthcare services to over 37 crore people.

- Under PM-Ayushman Bharat Health Infrastructure Mission (PM-ABHIM), over 700 Integrated Public Health Labs and 500+ Critical Care Blocks have been established.

- 31.86 crore teleconsultations conducted under E-Sanjeevani, making it the world’s largest telemedicine service.

- Ayushman Bharat Digital Mission (ABDM) has created 72.81 crore health IDs (ABHA) and linked 47.79 crore health records for seamless healthcare access.

- Nutrition and Food Security

- The PM Garib Kalyan Anna Yojana (PMGKAY) provided free food grains to 80 crore beneficiaries, ensuring food security.

- The Poshan Abhiyan has reached 12 crore children and 6 crore pregnant/lactating women, reducing malnutrition rates.

- The Mid-Day Meal Scheme (PM Poshan) benefited over 11.8 crore school children, improving nutritional intake and school attendance.

- Women and Child Welfare

- Over 9 crore women received direct benefits under PM Matru Vandana Yojana (PMMVY) to support maternal health.

- 4 crore LPG connections distributed under Ujjwala Yojana, reducing indoor air pollution and improving women’s health.

- The Beti Bachao Beti Padhao scheme led to an improvement in the Child Sex Ratio (CSR) from 918 (2015) to 931 (2024).

- Rural Development and Employment Generation

- 2.69 crore houses built under PM Awas Yojana-Gramin (PMAY-G), improving rural housing.

- 99.6% of targeted villages connected with roads under PM Gram Sadak Yojana (PMGSY), enhancing rural connectivity.

- 12.2 crore rural households provided with tap water connections under the Jal Jeevan Mission.

- 37 crore workers enrolled under e-Shram, ensuring access to social security benefits for unorganized sector workers.

- Technology and Innovation in Social Services

- Drones deployed in healthcare to deliver 10,000+ medical products over 15,000 km, reducing emergency response times from 8 hours to 22 minutes.

- The U-WIN platform digitized 26.4 crore vaccination records, improving immunization tracking.

- The Aadhaar-based Direct Benefit Transfer (DBT) system saved over ₹2.5 lakh crore by eliminating leakages in welfare schemes.

India’s social sector growth continues to be driven by technology adoption, financial inclusion, and targeted welfare programs, ensuring holistic development and improved living standards for all.

Chapter 12: Employment and Skill Development – Preparing for the Future

- Employment Trends and Labour Market Improvements

- India’s unemployment rate declined from 6.0% in 2017-18 to 3.2% in 2023-24, reflecting a post-pandemic recovery.

- The labour force participation rate (LFPR) increased from 49.3% to 50.4% in urban areas between Q2 FY24 and Q2 FY25.

- Self-employment is rising, with 58.4% of the workforce engaged in self-employment in 2023-24, up from 52.2% in 2017-18.

- The share of casual labour decreased from 24.9% to 19.8%, indicating a shift towards more structured employment.

- Government Initiatives for Job Creation

- The Union Budget 2024-25 allocated ₹2 lakh crore for employment and skilling initiatives benefiting 4.1 crore youth over five years.

- A new centrally sponsored skilling scheme aims to train 20 lakh youth and upgrade 1,000 ITIs to meet industry demands.

- The Prime Minister’s Internship Scheme (PMIS) provides internships in 500 top companies to 1 crore youth, offering a ₹5,000 monthly stipend.

- The EPFO salary support scheme offers ₹15,000 in three installments to first-time jobholders and subsidies for employer EPFO contributions.

- Skill Development and Industry Readiness

- Over 1.57 crore individuals trained under PMKVY, with 1.21 crore certified in various trades.

- The FutureSkills Prime program aims to upskill 13.21 lakh professionals in emerging fields like AI, big data, and cybersecurity.

- Vocational training remains a challenge, with 65.3% of the workforce lacking any formal vocational training.

- The female participation rate in skill programs has increased, with 58% of PMKVY trainees being women.

- International Mobility and Employment Opportunities

- India has 32 million people in its diaspora, with a rising demand for skilled Indian workers abroad.

- Bilateral agreements with Australia, Germany, Japan, and the UK are enabling global workforce mobility.

- The Pre-Departure Orientation Training program has provided 8-hour training to migrant workers to enhance overseas employment readiness.

- Future Challenges and Policy Focus

- AI and automation are reshaping job markets, requiring continuous reskilling and upskilling initiatives.

- Expanding public-private partnerships in skill training and vocational education is essential to align with Industry 4.0.

- To fully leverage its demographic dividend, India must focus on enhancing employability, reducing the skill gap, and creating quality jobs.

Chapter 13: Labour in the AI Era – Crisis or Catalyst?

- AI’s Impact on Labour Markets

- The International Labour Organization (ILO) estimates that 75 million jobs globally are at risk of AI-driven automation.

- A study by Goldman Sachs suggests nearly 300 million full-time jobs worldwide could be affected by AI adoption.

- McKinsey forecasts that up to 30% of current work hours in Europe and the U.S. could be automated by 2030.

- India’s AI Workforce Exposure

- 68% of Indian white-collar employees expect their jobs to be partially or fully automated by AI within the next five years.

- The Indian AI market is expected to grow at 25-35% CAGR by 2027, driving both job creation and displacement.

- Financial services, IT, and professional services have the highest exposure to AI-driven transformations.

- Skill Demand and Workforce Transition

- AI adoption is expected to increase demand for advanced cognitive skills, including critical thinking, problem-solving, and digital literacy.

- 57% of occupations in emerging markets, including India, will require new skills due to AI adoption.

- AI-skilled jobs are already paying 13-17% higher salaries compared to traditional roles, according to industry estimates.

- Challenges and Policy Directions

- The cost of AI development is rising, with OpenAI’s GPT-4 model costing $78.4 million to train and Google’s Gemini Ultra model costing $191.4 million.

- Infrastructure limitations, including data access, computing power, and AI governance frameworks, remain major obstacles to scaling AI adoption.

- India’s policy focus must balance AI-driven innovation with workforce protection, upskilling, and regulatory oversight to ensure inclusive economic growth.

AI presents both risks and opportunities. By investing in education, strengthening institutions, and promoting AI ethics, India can navigate this transition successfully and turn AI into a catalyst for economic progress rather than a crisis for the workforce.

Conclusion

The Economic Survey 2024-25 delineates a multifaceted economic roadmap, underscoring resilient fiscal policies, infrastructural dynamism, and strategic deregulation as cornerstone enablers of India’s growth continuum. The report highlights the importance of continued policy agility in response to dynamic global trends, ensuring a sustainable and inclusive economic trajectory.

Future policy directions emphasize the need for investment-driven growth, enhanced technological adoption, and environmental sustainability to navigate the complexities of the evolving economic landscape. As India progresses towards its long-term economic objectives, robust institutional frameworks and strategic policy recalibrations will be fundamental in achieving sustained prosperity.

Reference: Economic Survey

1 Comment